Partner With

Fin System

Let's Work Together

You Could Be a Perfect Fit

Fin System is a partnership of prosperous financial adviser entrepreneurs dedicated to our clients, fostering cooperation, value creation, and growth. When partner offices and advisors join Fin System, they may take advantage of a strategic platform of tools and technology that is unmatched in the industry, as well as marketing resources. The goal of Fin System is to enhance the entrepreneurial experience of our partners.

Looking to grow your Office

and leverage robust resources

Thinking about putting a

succession plan in place

Creating certainity for the future

of your team and clients

What We Offer to Our Client’s

MUTUAL FUND

INSURANCE

PORTFOLIO MANAGEMENT

BONDS & FIXED DEPOSITS

TAX PLANNING & SERVICES

FINANCIAL PLANNING

RETIREMENT PLANNING

REAL ESTATE

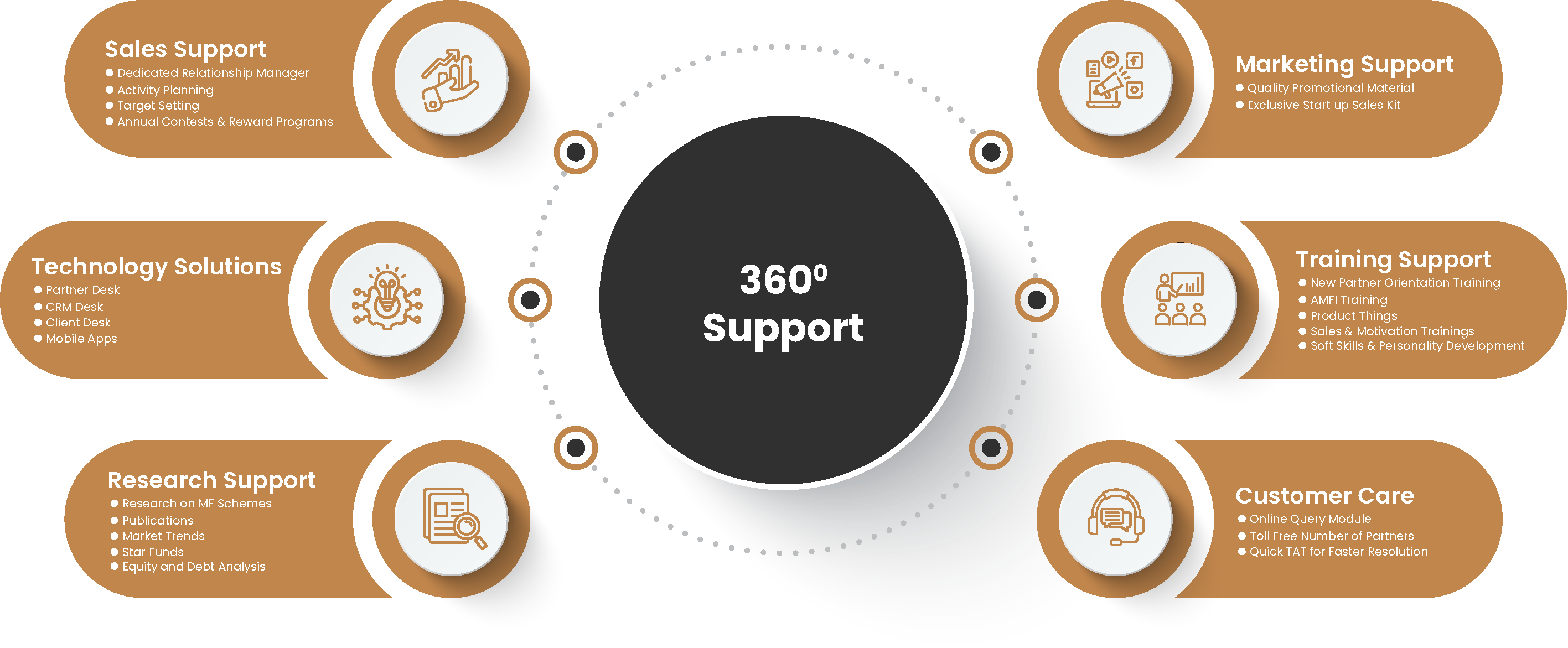

Why Partnership with Fin System

- SALES SUPPORT

- MARKETING SUPPORT

- TRAINING SUPPORT

- TECHNOLOGY SOLUTIONS

- RESEARCH SUPPORT

- CUSTOMER SUPPORT

- Dedicated Relationship Manager

- Dedicated Operation Executive

- Marketing Activity Planning

- Quarterly Contests and Incentives

- Fixing Marketing Activity

- Marketing Promotional Material

- Exclusive Sales kit

- Marketing & Social Media Management

- New Partner Induction Programme

- Products and Sales Training

- AMFI and Financial Planning Training

- Personality Development Programme

- Partner Desk

- CRM Desk

- Mobile Application

- Financial Planning Tool

- Research Reports on Mutual Fund Schemes

- Publication of Market Updates

- Market Analysis

- Publishing Recommended Funds

- Dedicated Team to Attend the Query

- Online Query Management

- Toll Free Number

- Conducting Regular Feedback Survey

Asset Allocation

This strategy involves investing in different

types of assets (Volatile and non-volatile) based

on the investor’s investment goals and risk

tolerance. Eventually, it can result in significant

returns with little risk.

Diversification

Investors or portfolio managers must diversify

the investment portfolio to spread the risk and

generate profits. Financial markets are volatile

and subject to risks. Hence, having a diverse

portfolio of assets with little or no correlation

means profit made by one can easily offset the

loss incurred by another.

Rebalancing

Market volatility may cause an investment plan

to diverge from its target allocation. Therefore,

rebalancing the portfolio based on market

conditions might result in higher returns with

little risk. The common ways to do this include

buying and selling assets as required or

increasing portfolio investment.

Tax Reduction

It is nothing more than figuring out a strategy to

avoid paying excessive taxes on investment

returns.

Frequently Asked Questions (FAQs)

For Existing Mutual Fund Distributors (ARN Holder)

There is no joining or registration fee.

For becoming a Mutual Fund Distributors:

Registration fees: 3,500 (Rs. 2000 for the NISM Mutual Fund V-A exam + 1500 fees for ARN

Applications to CAMS; ARN fees for non-individuals are different).

Fin System provides you with study materials like online training, study materials, mock tests,

and revision sessions.

Fin System will offer comprehensive assistance with business development. like a committedrelationship manager, technology, marketing, and sales support. Additionally, Fin System will provide you with numerous training sessions to improve your knowledge and sales abilities.

Yes, that is possible. You need to follow the ARN change process.

You can start this business as a part-time endeavour in addition to your job or other business, and

once you start earning a respectable commission from the MF business, you can start it full-time

if you so choose. However, you must allow yourself enough time to expand your knowledge and

network with clients in order to successfully grow your business.