Financial Planning

A Registered Investment Advisory Firm Offering Investment Management and Financial Planning

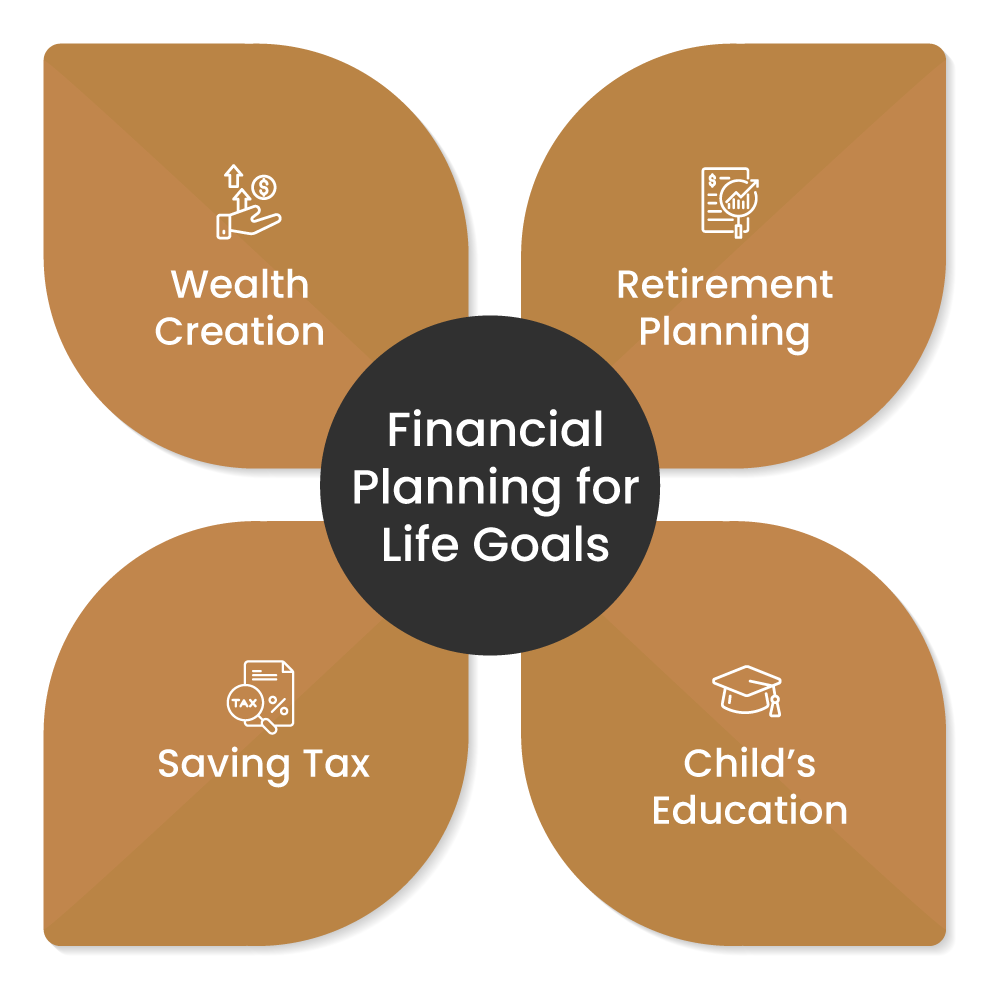

What is Financial Planning

Financial Planning starts by organising your finances and investments so you have a clear picture of your net worth. From there, you identify your most important life goals and prioritise you’re spending and saving. Taking into consideration investments, insurance requirements, and tax strategies, we’ll help you create a budget to cover today’s needs, anticipate tomorrow’s circumstances, and plan a path to future rewards.

Why should you do

Tax Planning?

There are a lot of options for tax saving in India. The income tax Act, 1961 has different sections which provide multiple options for tax saving and tax exemptions. Section 80C to 80U of the Income Tax Act gives all the options for possible tax deductions for the eligible taxpayers. As a taxpayer, you should be aware of the provisions available and make a legit use of those provisions to reduce your tax liabilities.

But while doing so, you should keep in mind that such tax planning is done under the legally defined framework of the Government of India. Tax planning is a legal and smart way to reduce your tax duties. But it is not a channel to avoid tax or evade tax. Tax avoiding or tax evading is illegal and can Land you in a lot of trouble and thus should be avoided. There are enough provisions and opportunities made available by the government to reduce the burden of tax on

the taxpayers.

Fin System assists in

Tax Planning and Financial Analysis

The purpose of tax planning is to ensure tax efficiency and maximize your tax savings. Tax

planning is an essential part of financial planning to reduce tax liability and maximize investor

wealth. Our core service is financial planning for salaried employees and strategies to reduce

one’s taxes.

Why should you opt for

Taxation Services at Fin System?

There are many different laws, rules, and regulations that make up the Indian taxation system. Because of this, taxation services at state and national levels encompass a wide range of tax related laws. As a result, financial tax planning can become complicated for someone without a background in taxes because they might not be able to grasp the regulations.

This is where the FIN SYSTEM team’s expertise can be of assistance. A team of chartered accountants on our staff is skilled in both individual and commercial tax planning. We take pleasure in the expertise of our consultants, who are familiar with how the Indian tax system operates. We have experience in various fields, whether it is corporate tax counselling services or NRI taxation services. All of our customers are equally valuable to us, and we develop our plans with their particular needs in mind.

What are Benefits of Financial Planning?

Increase your Savings

It may be possible to save money without having a financial plan. But it may not be the most efficient way to go about it. When you create a financial plan, you get a good deal of insight into your income and expenses. You can track and cut down your costs consciously. This automatically increases your savings in the long run.

Enjoy a Better Standard of Living

Most people assume that they would have to sacrifice their standard of living if their monthly bills and EMI repayments are to be addressed. On the contrary, with a good financial plan, you would not need to compromise your lifestyle. It is possible to achieve your goals while living in relative comfort.

Be Prepared for Emergencies

Creating an emergency fund is a critical aspect of financial planning. Here, you need to ensure that you have a fund that is equal to at least 6 months of your monthly salary. This way, you don’t have to worry about procuring funds in case of a family emergency or a job loss. The emergency fund can help you pay for varied expenses on time.

Attain Peace of Mind

With adequate funds at hand, you can cover your monthly expenses, invest for your future goals and splurge a little for yourself and your family, without worry. Financial planning helps you manage your money efficiently and enjoy peace of mind. Don’t worry if you have not yet reached this stage. If you are on the path of financial planning, the destination of financial peace is not very far away

Asset Allocation

This strategy involves investing in different

types of assets (Volatile and non-volatile) based

on the investor’s investment goals and risk

tolerance. Eventually, it can result in significant

returns with little risk.

Diversification

Investors or portfolio managers must diversify

the investment portfolio to spread the risk and

generate profits. Financial markets are volatile

and subject to risks. Hence, having a diverse

portfolio of assets with little or no correlation

means profit made by one can easily offset the

loss incurred by another.

Rebalancing

Market volatility may cause an investment plan

to diverge from its target allocation. Therefore,

rebalancing the portfolio based on market

conditions might result in higher returns with

little risk. The common ways to do this include

buying and selling assets as required or

increasing portfolio investment.

Tax Reduction

It is nothing more than figuring out a strategy to

avoid paying excessive taxes on investment

returns.

Financial Planning at

Fin System

Fin System combines its foundations in investment management and financial planning with advanced advisory services to create a truly customized client experience. Our holistic financial planning process includes the oversight and stewardship of all elements of your financial life.

A customised personal financial plan can help you feel confident that you’ll achieve what you want out of life, whether it’s early retirement, funding college education for your kids or grandkids, real estate, investment in a second home, or financing a new business venture. We are successful at helping our clients align their wealth with their goals and values through defining family missions and keeping those missions at the forefront of our advice and coordinated investment plans.

Financial Planning Process

at Fin System

Setting Short-Term, Medium -Term, and Long-Term Financial Goals

Collecting personal Information Financial Assets and Liabilities, Income and Expenses

Calculating Net Worth, Analyzing Cash Flow, Evaluating Dept-To-Income Ratio and Risk Tolerance

Creating a Budget, Developing Investment Strategies, Tax Planning, Risk Management and Insurance, Retirement Planning and Estate Planning

Prioritizing Actions, Allocating Resources, and Seeking Professional Advice

Conducting Periodic Reviews, Adapting to life changes and External Factors, and Updating Goals and Strategies

What Makes Fin System the

Best Option for Financial Planning?

DISCOVER

We spend the time with you to develop a comprehensive understanding of your current needs, future goals, and personal or family ambitions—the crucial context needed to plan, invest, and forge an effective partnership.

PRIORITIZE

You'll receive a tailored financial plan that helps you define your goals and organize your finances. This foundation allows us to make thoughtful decisions together that are in your long-term best interests.

IMPLEMENT

This step includes creating an investment portfolio strategically structured by our in- house investment team, balanced by your short-, medium-, and long-term goals, and risk tolerance.

MONITOR

Our goal is to limit the surprises, and our responsibility is to continually keep you informed through transparent reporting and proactive recommendations aligned to your goals and objectives. When you have questions, we will be there to help you find the right answers.

Frequently Asked Questions (FAQs)

The Financial Planning Process is a comprehensive and ongoing approach to managing one’s finances.It involves evaluating one’s current financial situation, identifying financial goals, creating a plan to achieve those goals, implementing the plan, and regularly monitoring and adjusting the plan as

needed.

The Financial Planning Process is important because it helps individuals and families make informed decisions about their money, which can have a significant impact on their quality of life. It provides a roadmap for achieving financial goals, such as buying a home, saving for retirement, or paying for a child’s education.

While it is possible to go through the Financial Planning Process on your own, many people find it helpful to work with a financial planner. A financial planner can provide expertise and guidance in areas such as investment planning, retirement planning, tax planning, and risk management.

It is recommended that you review your financial plan at least once a year or whenever there is a significant change in your financial situation, such as a change in income or an unexpected expense. Regular reviews can help ensure that your plan remains relevant and effective in helping you achieve

your financial goals.

What Our Clients Say About Us