Mutual Funds

“Equity mutual funds are the perfect solution for people who want to own stocks without doing their own research.” ~ Peter Lynch

What are

MUTUAL FUNDS?

A mutual fund is a financial vehicle that collects & pools money from a number of investors and invests the same in equities, bonds, government securities, money market instruments. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

The money collected in mutual fund scheme is invested by professional fund managers in stocks and bonds etc. in line with a scheme’s investment objective. The income / gains generated from this collective investment scheme are distributed proportionately amongst the investors, after deductingapplicable expenses and levies, by calculating a scheme’s “Net Asset Value” or NAV.

HOW DOSE A MUTUAL

FUND WORKS?

Avoid the temptation to evaluate the performance of the fund whenever the market takes a large hit or gain. It takes an actively managed equity programme between 18 and 24 months to produce returns in the portfolio, therefore one needs to be patient and give themselves enough time.

When you invest in a mutual fund, you are pooling your money with many other investors. A Mutual fund issues “Units” against the amount invested at the prevailing NAV. Returns from a mutual fund may include income distributions to investors out of dividends, interest, capital gains, or other incomeearned by the fund. You can also have capital gains (or losses) if you sell the mutual fund units for more(or less) than the amount you invested.

Asset Allocation

This strategy involves investing in different

types of assets (Volatile and non-volatile) based

on the investor’s investment goals and risk

tolerance. Eventually, it can result in significant

returns with little risk.

Diversification

Investors or portfolio managers must diversify

the investment portfolio to spread the risk and

generate profits. Financial markets are volatile

and subject to risks. Hence, having a diverse

portfolio of assets with little or no correlation

means profit made by one can easily offset the

loss incurred by another.

Rebalancing

Market volatility may cause an investment plan

to diverge from its target allocation. Therefore,

rebalancing the portfolio based on market

conditions might result in higher returns with

little risk. The common ways to do this include

buying and selling assets as required or

increasing portfolio investment.

Tax Reduction

It is nothing more than figuring out a strategy to

avoid paying excessive taxes on investment

returns.

Types of Mutual Fund

Mutual funds can be categorised in a variety of ways, including by their structure, the kind of securities they hold, their investment strategy, etc. We have attempted to summarise some of the mutual fund classifications formulated by the Securities and Exchange Board of India (SEBI) below. What we provide you with here is not an extensively categorized list of mutual funds, but rather a few popular ones to get you started.

Open-Ended Funds

Open-ended funds

Open-ended funds are mutual funds that are perpetual in nature and allow you to make investments and redeem them at any time. They don't have a set investment time and are liquid in nature.

Close-Ended Funds

Close-ended Funds

Close-ended schemes have a fixed maturity date. Only when a fresh fund is offered for investment may you invest, and redemption is only possible at maturity. A closed-ended mutual fund's units cannot be bought at any time.

Equity Mutual Funds

Equity Mutual Funds

Equity Mutual Funds invest at least 65% of their assets in stocks of companies listed on the stock exchange. They are more suitable as long-term investments (> 5 years) as stocks can be volatile in the short term. They have the potential to offer higher returns but also come with high risk. Here are a few types of equity mutual funds–

- Large-cap Funds invest at least

80% of their portfolio in stocks of large-cap companies i.e., the companies that are ranked in the first 100 in the list of stocks prepared by AMFI depending on market capitalization. - Mid-cap Funds invest at least 65% of their portfolio in stocks of mid- cap companies i.e., the companies that are ranked between the 101st and 250th based on their market capitalization.

- Small-cap Funds invest at least 65% of their portfolio in stocks of small-cap companies i.e., the companies that are ranked 251st and above based on their market capitalization.

- ELSS (Equity Linked Savings Scheme) is a tax-saving equity mutual fund. It invests at least 80% of its portfolio in stocks. The investment made under ELSS is eligible for tax deduction under section 80C, of the Income Tax Act, 1961 up to Rs 1.5 Lakh per annum. ELSS also comes with a lock-in of 3 years from the date of investment.

- Multi-cap Funds invest in stocks of any companies across all market capitalization, namely, large-cap, mid-cap, and small-cap stocks. There is no investment limit defined by SEBI at the market capitalization level.

- International Funds are schemes that invest equity of companies listed outside India. The objective of these funds is to provide an element of geographical diversification to investors and counter the volatility of Indian markets as foreign markets do not necessarily move in sync with Indian markets.

- Index Funds: An Index Fund is a type of mutual fund that simply impersonates an index. So, when you invest in index funds, fund managers deploy your money in the same companies and in the same proportion as the index they are tracking.

Debt Mutual Funds

Debt Mutual Funds

Debt Mutual Funds primarily invest in fixed-income instruments like Government securities, corporate bonds, and other debt instruments. They are not affected by stock market volatility and hence, can offer more stable returns compared to equity mutual funds. The types of debt mutual funds are differentiated on the basis of the maturity period of the securities they hold.

Let’s look at a few types of debt mutual funds- is

- Liquid Funds invest in debt securities and higher-rated securities which have a maturity period of fewer than 91 days.

- Overnight Funds invest in securities with a maturity of one day. These funds come with low risks safety because of shorter maturity periods, the interest rate risk is on the lower side. These are commonly used by corporates to park their funds.

- Money Market Funds invest mainly in government securities (known as treasury bills) and similar instruments, which are short-term with maturity periods of less than one year. These funds are suitable for investors looking for stable and non-volatile funds as interest risk is less.

- Banking & PSU Funds invest at least 80% of their investment in debt securities of banks, public sector undertakings, municipal bonds, public financial institutions, etc. They can be better suited for investors looking for short to medium-term investment tenure.

- Glit Funds invest a minimum of 80% in Government securities across maturity periods. The nature of investment makes it more suitable for a long-term investment as Government securities can be volatile in the short term.

- Short Duration Funds invest in debt and other money market securities such that the average maturity of the portfolio is between 1-3 years. They are more suited for investors looking at an investment time frame of 1-3 years and moderate risk appetite.

Hybrid Mutual Funds

Hybrid Mutual Funds

Hybrid Mutual Funds invest in both equity and debt in varying proportions depending on the investment objective of the fund. Thus, hybrid funds give you diversified exposure to various asset classes. Hybrid funds are categorized on the basis of their allocation to equity and debt. Let us look at a few categories-

- Aggressive Hybrid Funds are a type of hybrid fund that can invest 65-80% of their portfolio in equity and 20-35% in debt instruments. As a result of a greater allocation to equity, they prove to be riskier than the balanced hybrid category.

- Conservative Hybrid Funds invest at least 75-90% of their portfolio in debt securities and the remaining 10-25% in equity securities.

Because of this allocation, they may prove to be relatively less risky than, say, an aggressive hybrid fund. - Balanced Advantage Funds, also known as dynamic asset allocation funds keep their investments in equity and debt dynamic in nature. As per the market movement, their allocation to both asset classes keeps changing so as to maximize the gains and minimize the risks.

Modes of Mutual Fund Investment

Lumpsum

When you want to

invest a significant amount in a

mutual fund in one go.

For example, if you had a sum of

Rs 1 lakh to invest then you could

go in for lumpsum investment and

invest the entire amount of Rs 1.0

lakh at one go in a mutual fund of

your choice. The units allotted to

you will depend on the NAV of

that fund on that particular day. If

the NAV is Rs 1000, you will end

up getting 100 units of the mutual

fund.

SIP(Systematic Investment Plan)

A Systematic Investment Plan

(SIP), more popularly known as

SIP, is a facility offered by mutual

funds to the investors to invest in

a disciplined manner. SIP facility

allows an investor to invest a

fixed amount of money at pre-

defined intervals in the selected

mutual fund scheme.

For example, investing Rs 5000

per month total in two different

mutual funds of Rs 2500 each

would be a SIP.

Mutual Fund

Calculator

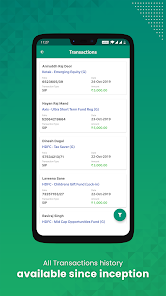

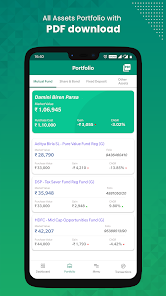

Download Our App

Track and analyze all your investments in single View.

Start Your Mutual Fund Investement Today!

- Zero Account Opening Charges

- Less than 10 minutes get yourself Onborded

- Dedicated releationship Manager

- Dedicated customer Support team

- Adoption of advanced technology

- Regular Portfolio review conduct

Frequently Asked Questions (FAQs)

Upon successfully completing your onboarding process, you can start making investments immediately.

To open an account on our Platform, these documents should be readily available during the onboarding process: PAN card number, Cancelled cheque / latest bank statement and Photo of signature.

Stocks are generally riskier than mutual funds. When an investor pools in a lot of stocks in a stock fund or bonds in a bond fund, mutual funds reduce the risk of investing. This lowers the risk, thanks to diversification. For that reason, many investors feel that mutual funds provide the benefits of stock

investing without the risks.period, portfolio management could produce higher returns on investment with fewer risks. The growth and stability of managed investments are ensured by investing in a variety of assets. Capital growth, efficient resource use, and a bright financial future are other advantages.

The purpose of investing in mutual funds is to earn higher returns than what traditional investments offer. These higher returns are mainly because of more extensive market exposure and professional fund management. This is available at a nominal initial capital via the Systematic Investment Plan (SIP) route. So, it is a good idea.investing without the risks.period, portfolio management could produce higher returns on investment with fewer risks. The growth and stability of managed investments are ensured by investing in a variety of assets. Capital growth, efficient resource use, and a bright financial future are other advantages.

A New Fund Offer (NFO) refers to the introductory offer of a scheme by an AMC. A new fund offer is raised when a fund is launched, which helps the firm raise capital for purchasing securities.

An investor can subscribe to an NFO only within a limited time period; hence, NFOs are functional on a first-come-first serve basis.

You can invest in mutual funds in the name of a minor child. The minor child is the sole holder in the mutual fund folio. The guardian for the mutual fund folio must be a parent or a court-appointed guardian.

Systematic Investment Plan or SIP is a method of investing in mutual funds. You may invest a fixed amount regularly in a mutual fund scheme of your choice. You can invest just Rs 500 per instalment in a mutual fund through the SIP.